s corp tax calculator excel

Lets start significantly lowering your tax bill now. If you are self-employed you have to pay both the employer and employee portion which was 153 in 2016.

Calculate Salary Allowances And Tax Deduction In Excel By Learning Center In Urdu Hindi

Forming operating and maintaining an S-Corp can provide significant tax benefits.

. Electing S corp status allows LLC owners to be taxed as employees of the business. Use our detailed calculator to determine how much you could save. Our S corp tax calculator will estimate whether electing an S corp will result in a tax.

The use of this template ensures that the calculations are accurate and. Use this calculator to get started and uncover the tax savings youll receive as an S Corporation. An S corporation S corp is a tax status under Subchapter S of the IRS tax code that you can elect for your limited liability company LLC or corporation.

Ad eFiling Is The Quickest Way To Submit Your Return All From The Comfort Of Your Home. Completing a Tax Organizer will help you avoid overlooking important information and contribute to an efficient preparation of your tax returns. On this page you will find.

Calculating Your S-Corp Tax Savings is as Easy as 1-2-3. Read about the tax benefits of a C-Corp considerations for which entity type to form a business as forming an LLC versus a corporaiton switching an LLC to a C-Corp and more. Over the years I have fine-tuned my Excel spreadsheet to require as little input as necessary especially when it comes to correctly calculate my income tax withholding based on the various brackets.

Compile information for your S-Corp tax return with ease using one of our 2019 S-Corp Tax Organizers. 2Select the cell you will place the calculated result at enter the formula SUMPRODUCTC6C12-C5C11C1. We are not the biggest.

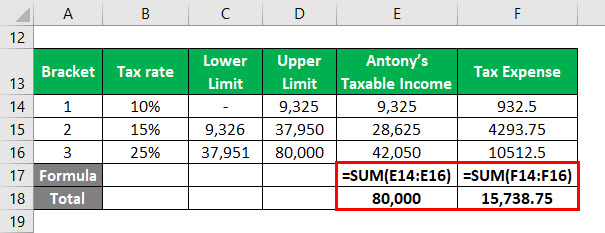

Remember the more you learn about S corps the easier it will be for you to decide if its the right business entity for you. Actually you can apply the SUMPRODUCT function to quickly figure out the income tax for a certain income in ExcelPlease do as follows. This page and calculator are not intended to be used and cannot be used by a taxpayer for the purpose of avoiding penalties that may be imposed by law.

Annual cost of administering a payroll. Also take a look at our blog and video at What you Really Need to Know About S-Corp Tax Savings. For example if you pay yourself.

As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153 13770. Self-employed business owners pay a 153 percent tax rate on all income under 94200 and. MS Excel can be easily converted into a calculator by defining some formulas related to what you want to calculate.

The SE tax rate for business owners is 153 tax of the first 142800 of income and 29 of everything over 142800. This tax is also known as the FICA Medicare or social security tax and is levied on your entire income. This allows owners to pay less in self-employment taxes and contribute pre-tax dollars to 401k and health insurance premiums.

I created this S corp tax savings calculator to give you a place to start. However sometimes a CPA can help you avoid expensive state unemployment so with them first. S corp tax calculator excel Sunday May 29 2022 Edit.

UK Corporation Tax Calculator. Total first year cost of. IRS CIRCULAR 230 NOTICE.

1In the tax table right click the first data row and select Insert from the context menu to add a blank rowSee screenshot. This calculator template is prepared in MS Excel format. Our calculator will estimate whether electing S corp will result in a tax win for your business.

Estimated Local Business tax. S Corp Tax Calculator - S Corp vs LLC Savings. The template contains all those details which are needed by the user to calculate the corporate tax.

Enter your estimated annual business net income and the reasonable salary you will pay yourself as an S Corporation employee to begin. S-Corp Tax Savings Calculator. Our S corp tax calculator will estimate whether electing an S corp will result in a tax win for your business.

There is not a simple answer as to what entity is the best in terms of incorporation. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. S-Corp Tax Savings Calculator.

Lets start significantly lowering your tax bill now. Normally these taxes are withheld by your employer. Annual state LLC S-Corp registration fees.

As youre running through the calculations above be sure to talk to a financial pro to help you weigh the pros and cons. Instructions for Downloading the S-Corp Tax Organizer for your Business How. 95741 AGI 2247134 Total tax 7326966 Whats the tax savings between these two.

I tried to find an example for Excel that would calculate federal and state taxes based on the 2017201820192020 brackets. The S-corporation Tax Savings Calculator allows you to compare SOLE-PROPRIETOR VS. The corporation tax calculator allows companies in the UK and companies based outside the UK with offices or branches in the UK to calculate their corporation tax based on their companies financial year or using a standard tax year the 2022 tax year for example runs from the 1 st April 2022 to the 31 st March 2023.

Cash Management Payroll 101 What Every Small Small Business Community Cash Management Community Business Payroll

Intuit Quickbooks Desktop Pro 2021 With Payroll Enhanced Windows

Download A Sample Balance Sheet Template For Microsoft Excel August 2021 ᐅ The Poetry House Financial Balance Sheet Template Balance Sheet Financial Statement

Effective Tax Rate Formula Calculator Excel Template

Commercial Credit Application Form Ready Made Office Templates

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Sole Proprietorship Vs S Corp Tax Spreadsheet For Internet Publisher And Youtuber Which Will Save More Tax Money Techwalls

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Effective Tax Rate Formula Calculator Excel Template

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

How To Use If And Or Function Together In Excel

Hse Report Template Professional Bewerbermanagement Excel Vorlage Einfach Hr Strategy Document Best Templates Ideas